Business Taxes with Mark Kohler

Video Series • About

Latest Episode

The 12 Tax Days of Christmas: Day 12

Charitable taxpayers are rewarded with powerful incentives, but there are lots of options and rules to keep in mind.

Episodes

The 12 Tax Days of Christmas: Day 12

Charitable taxpayers are rewarded with powerful incentives, but there are lots of options and rules to keep in mind.

The 12 Tax Days of Christmas: Day 11

FSAs may be more common for bigger businesses, but the savings don't have to be small.

The 12 Tax Days of Christmas: Day 10

Clearing up confusion about RMDs.

The 12 Tax Days of Christmas: Day 9

If you'd rather be taxed on your retirement savings now than later, considering converting to a Roth IRA.

The 12 Tax Days of Christmas: Day 8

Pre-paying expenses this year and pushing income into next year can save thousands.

The 12 Tax Days of Christmas: Day 7

The Tax Cuts and Jobs Act has allowed for amazing auto deductions from now until 2023.

The 12 Tax Days of Christmas: Day 6

How the HRA essentially allows you to reimburse yourself for all your health-care expenses.

The 12 Tax Days of Christmas: Day 5

By teaching your children about small business, you can save money and pass on a legacy.

The 12 Tax Days of Christmas: Day 4

Putting your spouse on payroll can be a wonderful strategy, or a nightmare that could cost you thousands.

The 12 Tax Days of Christmas: Day 3

Exploring the Solo 401(k) strategy.

The 12 Tax Days of Christmas: Day 2

Prepare for the new tax year.

The 12 Tax Days of Christmas

Day One: Define Your S Corporation Payroll.

How to Track Your Startup Costs and Save Money

Don't let a penny go to waste.

5 Reasons Why Even Small Companies Need a Board of Directors

A board can help you save on taxes, stay accountable and make better decisions for your business.

Don't Be Afraid to Write Off Your Home Office If You Meet These 2 Requirements

Entrepreneur Network partner Mark J. Kohler lays out the basics of deducting your home office.

About Business Taxes with Mark Kohler

Discover Entrepreneur Series

Whether you need advice on how to get your business off the ground or you’re just looking for inspiration, our video series have something for everyone. Browse our library below to find a series that speaks to you and your interests.

Carousel

Carousel-

5-Minute Mentor

Our mentors sit down with small business owners to find solutions to their most pressing pain points — in five minutes or less. -

No Drama Office

Working in an office can be crazy — but it doesn't have to be! In this new comedy series, watch as people learn to navigate the twists and turns that come with the nationwide return to the workplace. -

Entrepreneur Elevator Pitch

Your favorite pitch show is back with new entrepreneurs pitching Entrepreneur's investors. -

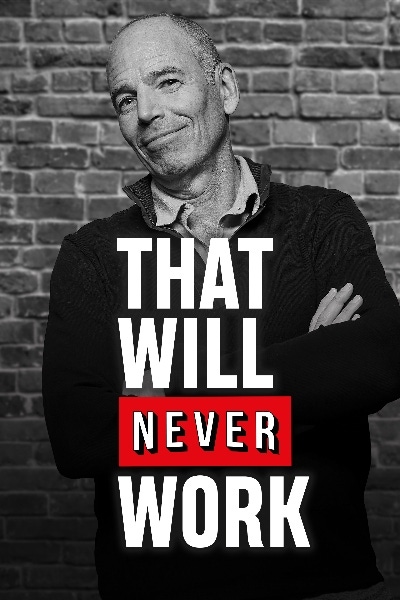

That Will Never Work

How many times have you been told “that will never work”? Probably not as often as Netflix co-founder Marc Randolph. The veteran Silicon Valley entrepreneur provides a healthy dose of humor, and actionable advice that will benefit founders - and would-be founders - at every stage of their business journey. -

Restaurant Influencers

Every week host and restaurant owner Shawn P. Walchef talks with leaders in restaurant and hospitality about their secrets to finding success with customers and growing a brand online. -

Jessica Abo

Jessica Abo covers the causes people care about, the powerful work they do and how they got to where they are in the first place.